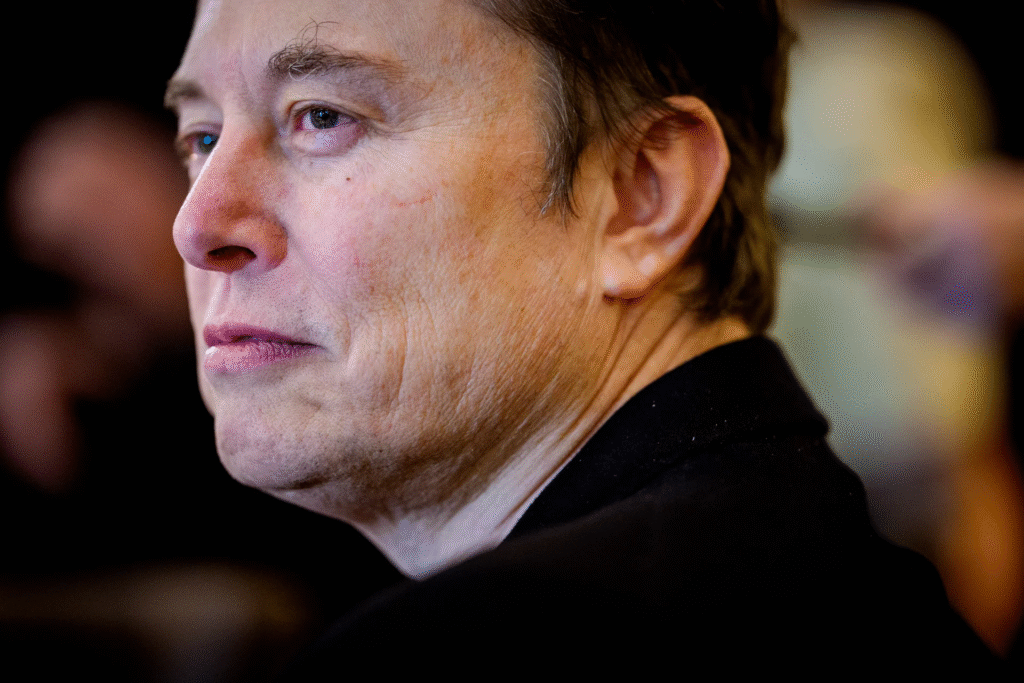

Musk convinced his board to hand him a monster pay package—but that was before Tesla lost more than $500 billion in market value.

Last year, the board of the Hertz Corporation took the keys away from CEO Stephen Scherr, who decided to step down after the wheels came off the company’s strategy to invest in Teslas and other EVs.

Hertz got stuck with thousands of unwanted electric vehicles because range anxiety—renters’ concerns about how far EVs could go—overcame any wow factor associated with EVs. High sticker prices didn’t help either, especially when Tesla slashed prices of new cars to boost sales, causing the resale value of rental vehicles to plummet.

Now it’s Tesla itself that is stuck with unwanted cars and pickups—and maybe an unwanted CEO.

The Tesla board has reportedly started a search for a new CEO and informed Elon Musk that he needs to spend more time at the company. The search for Musk’s replacement has been going on for about a month, according to the Wall Street Journal. Musk, per the Journal’s reporting, has not resisted his board in this matter. Tesla has denied the story.

Featured Video

An Inc.com Featured Presentation

But what took so long? The brand is now toxic, thanks to Musk’s hard turn from green EV seller to President Trump’s right hand, a position that Musk seemingly purchased by spending $300 million to get the famously EV-averse president elected.

Musk’s stint as head of the Department of Government Efficiency (DOGE) has earned him even more enmity both inside and outside the White House. The GOP’s nativist wing (Steve Bannon presiding) can’t wait until he exits because Musk is in favor of importing humans—you know, immigrants—to work in tech jobs. He’s also anti-tariff, which you’d expect from a guy who builds cars in China and Europe.

Tesla has paid the price for Musk’s corrosive personality. Profits fell 71 percent in the company’s first quarter of 2025, as sales dropped 11 percent worldwide. Sales were off 50 percent in some European countries and unlikely to rebound, especially as competitors such as Kia, BMW, and Volvo have brought new EVs to market. Keep in mind that in the auto business, when you lose a customer, you don’t get a chance to get them back for five or six years.

None of this had to happen. Musk essentially created the American market for EVs by investing in Tesla as its original founders struggled to bring their vehicle to market. Eventually Tesla, under Musk, learned how to actually manufacture EVs, and sales took off, especially among progressive types: greens, celebs…Democrats.

Then Musk decided, like so many Tesla drivers, to take his hands off the wheel.

Tesla’s offerings are now tired and uninspiring, while its new Cybertruck is a rolling laughingstock of a new product launch. And there’s not much in the way of new models coming down the line other than the much-promoted robotaxi. But a number of analysts think Tesla won’t meet its own deadline, at least not in significant numbers. This is unsurprising, since Musk has been promising and failing to deliver fully self-driving cars for a decade.

In most consumer products companies, if the CEO flops at new products and his erratic behavior damages the brand and alienates a large segment of potential customers, the board would be duty-bound to step in and dump him.

But Tesla isn’t like most companies—and its board is far from ordinary: It not only resisted getting rid of Musk, it has also gone out of its way to overpay him. In conventional terms, the board might be accused of dereliction of duty. Then again, this is Musk’s board—beginning with his brother Kimbal and his former chief technology officer, JB Straubel—leaving just five other board members to act on shareholders’ behalf.

That includes the chair, which is occupied by Robyn Denholm, an Australian tech executive who has been described as “hand-picked” by Musk. She has cashed in more than $500 million in Tesla stock—and with it any credibility about representing the shareholders. Why would she?

In January 2024, the Delaware Court of Chancery agreed with a shareholder plaintiff that Musk’s potential $55.8 billion pay package was a “conflicted-controller” transaction. Was it ever. Rather than accept the court’s decision, the board then put the pay package to a vote of shareholders in the company’s proxy, which won approval.